fulton county ga sales tax rate 2019

Rate Changes Effective April 1 2022 15776 KB Rate Changes Effective January 1 2022 526 KB Rate Changes Effective April 1 2021 5436 KB Rate Changes Effective October 1 2021 5244 KB Rate Changes Effective July 1 2021 5278 KB. The Georgia state sales tax rate is currently.

Sales Tax Rates In Major Cities Tax Data Tax Foundation

The state sales tax rate in Georgia is 4000.

. Atlanta GA Sales Tax Rate The current total local sales tax rate in Atlanta GA is 8900. Georgia state sales tax. Atlanta GA 30303 404-612-4000 customerservicefultoncountygagov.

A county-wide sales tax rate of 26 is applicable. The 2018 United States Supreme Court decision in South Dakota v. Sales Tax - Upcoming Quarterly Rate Changes.

Upcoming quarterly rate changes. Helpful Links Cities of Fulton County. 26 Votes The minimum combined 2020 sales tax rate for Fulton County Georgia is 89.

Fulton County Sheriffs Tax Sales are held on the first Tuesday of each month between the hours of 10 am. Personal finance personal taxes. Code Jurisdiction Rate Type Code Jurisdiction Rate Type Code Jurisdiction Rate Type 001 Appling 8 L E S T 002 Atkinson 8 L E S T 003 Bacon 8 L E S T 004 Baker 7 L E S.

Effective July 1 2019 GEORGIA SALES AND USE TAX RATE CHART Effective July 1 2019 Code 000 - The state sales and use tax rate is 4 and is included in the jurisdiction rates below. If your business is based in Atlanta or you sell to customers in Atlanta then the sales tax rate is 49. Fulton County Tax Commissioner Dr.

With local taxes the total sales tax rate is between 4000 and 8900. Fulton County sales tax. The Georgia state sales tax rate is currently 4.

This is the total of state and county sales tax rates. Except when the first Tuesday of the month falls on a legal holiday in which case the sale is held. Average Sales Tax With Local.

The December 2020. This coupled with the base rate of Georgia sales tax means the effective rate is 89. The total 775 Fulton County sales tax rate is only applicable to businesses and sellers that are not in the Greater Atlanta area.

Georgia has 961 cities counties and special districts that collect a local sales tax in addition to the Georgia state sales taxClick any locality for a full breakdown of local property taxes or visit our Georgia sales tax calculator to lookup local rates by zip code. The Fulton County Tax Commissioner is responsible for collecting property taxes on behalf of Fulton County Government two school systems and some city governments. Ferdinand is elected by the voters of Fulton County.

Select the Georgia city from the list of popular cities below to see its current sales tax rate. 18 rows The Fulton County Sales Tax is 26. The December 2020 total local sales tax rate was also 7000.

The tax rate for the first 500000 of a motor vehicle sale is 9 because all local taxes apply. General Rate Chart - Effective January 1 2020 through March 31 2020 1878 KB General Rate Chart - Effective October 1 2019 through December 31 2019 1877 KB General Rate Chart - Effective July 1 2019 through September 30 2019 2167 KB General Rate Chart - Effective April 1 2019 through June 30 2019 28941 KB. Surplus Real Estate for Sale.

3 rows The current total local sales tax rate in Fulton County GA is 7750. To review the rules in. The December 2020 total local sales tax rate was also 8900.

The Fulton County sales tax rate is. The Board of Commissioners and County Manager have categorized County efforts into six strategic areas. Popular Counties All A B C D E F G H I J K L M N O P Q R S T U V W Y Z.

FULTON COUNTY GEORGIA July 2019 FINANCIAL RESULTS Unaudited Cash Basis. Atlanta is in the following zip codes. The current total local sales tax rate in Floyd County GA is 7000.

30301 30302 30303. And pursuant to the requirements of OCGA. A tax sale is the sale of a Tax Lien by a governmental entity for unpaid property taxes by the propertys owner.

6 rows The Fulton County Georgia sales tax is 775 consisting of 400 Georgia state. Georgia has recent rate changes Thu Jul 01 2021. The Fulton County Board of Commissioners does hereby announce that the 2021 General Fund millage rate will be set at a meeting to be held at the Fulton County Assembly Hall located at 141 Pryor Street Atlanta GA 30303 on August 18 2021 at 10 am.

The Fulton County sales tax rate is 3. The tax rate for the portion of a motor vehicle sale that exceeds 500000 is 8 because the 1 regional TSPLOST does not apply. 48-5-32 does hereby publish the following.

445 802 Views. Sales Tax Breakdown Atlanta Details Atlanta GA is in Fulton County. If you need access to a database of all Georgia local sales tax rates visit the sales tax data page.

Georgia has state sales. Has impacted many state nexus laws and sales tax collection requirements. The Fulton County Tax Commissioner is responsible for the collection of Property Taxes for Fulton County government Fulton County and City of Atlanta Schools the State of Georgia and the cities of Atlanta Mountain Park Sandy Springs Johns Creek and Chattahoochee Hills.

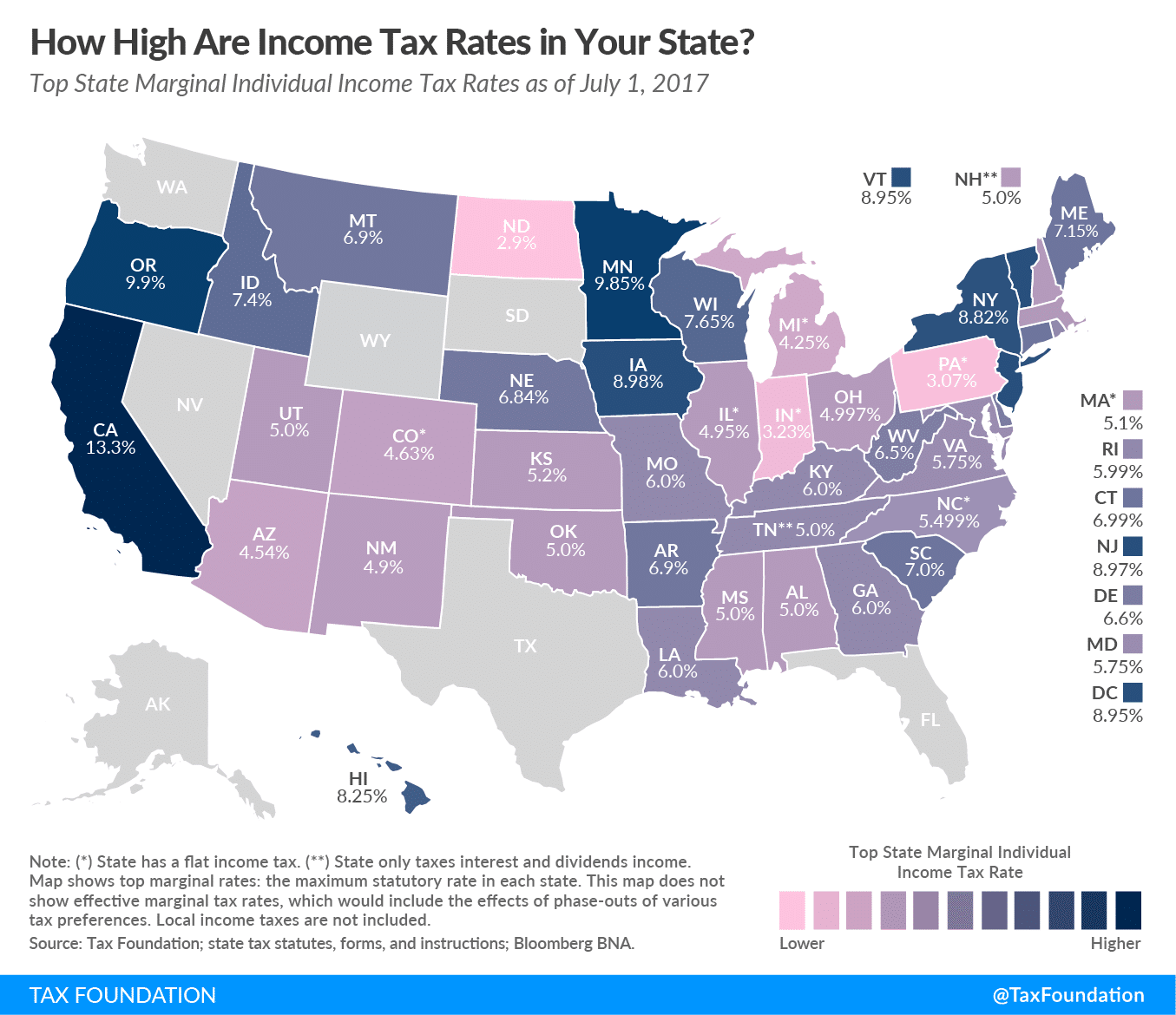

Federal Tax Reform Opens Opportunities For Georgia And For Rural Georgia Georgia Public Policy Foundation

Sales Taxes Up Across Area Down In Olean News Oleantimesherald Com

Atlanta Georgia S Sales Tax Rate Is 8 5

Sales Taxes In The United States Wikiwand

This Is The Most Expensive State In America According To Data Best Life

Sales Taxes In The United States Wikiwand

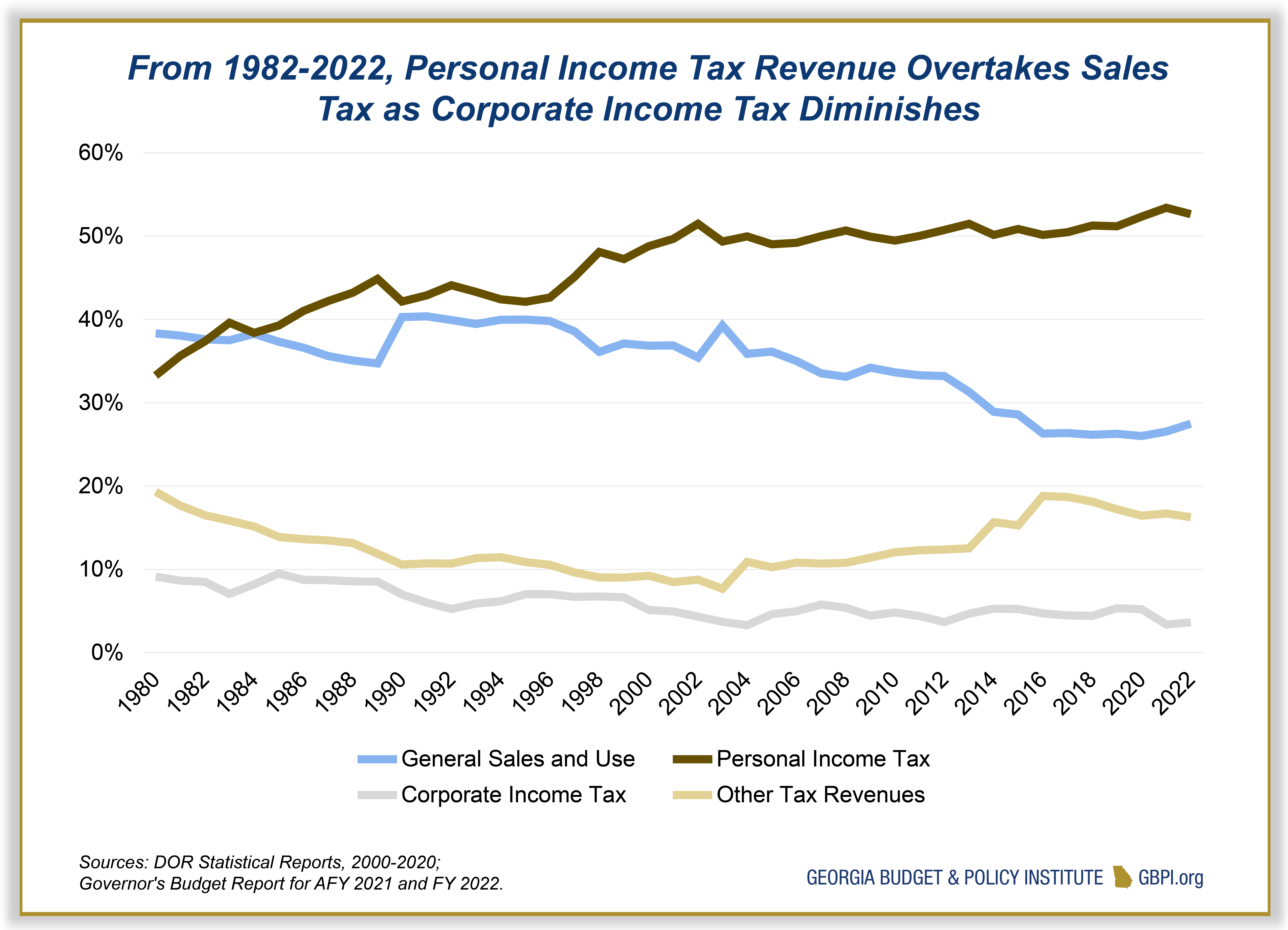

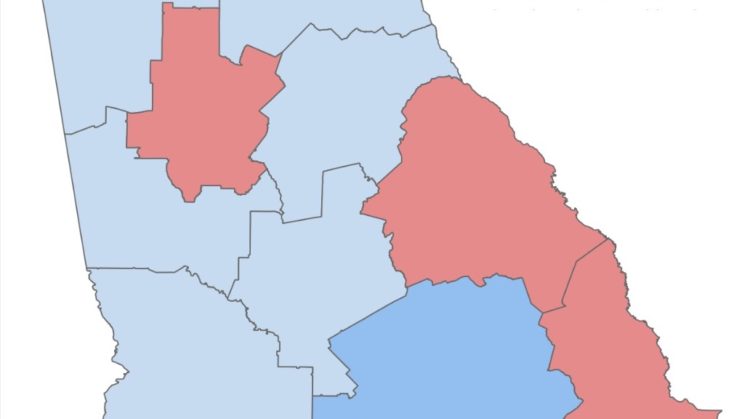

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Georgia Used Car Sales Tax Fees

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Georgia State County City Municipal Tax Rate Table Sales Tax Number Reseller S Permit Online Application

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

News Alert Buyers Beware Businesses Beware Sales Tax Rates Changing For Atlanta Fulton County S J Gorowitz Accounting Tax Services P C

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Sales Tax Collections Plummet At Least 15 In Metro Atlanta In June New Gsu Research Tool Saportareport

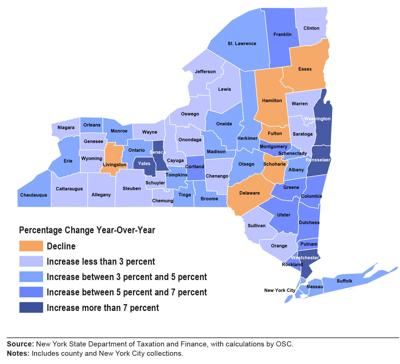

New York Sales Tax Guide For Businesses

Atlanta Real Estate Market Stats Real Estate Marketing Atlanta Real Estate Marketing

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy